Exchange visits

VBSP conducted the exposure visit to India on learning digital finance transformation

(VBSP News) MSC Global Consulting Pte Ltd (MSC), with support from the MetLife Foundation, is currently providing technical assistance and advisory services for VBSP to develop Mobile Banking service for the poor and other last-mile populations under the Innovate, Implement, Impact (i3) Program in Vietnam. Therefore, VBSP’s team had an exposure visit to India during February 24-28, 2020 to learn experience lessons on digital financial transformation in India.

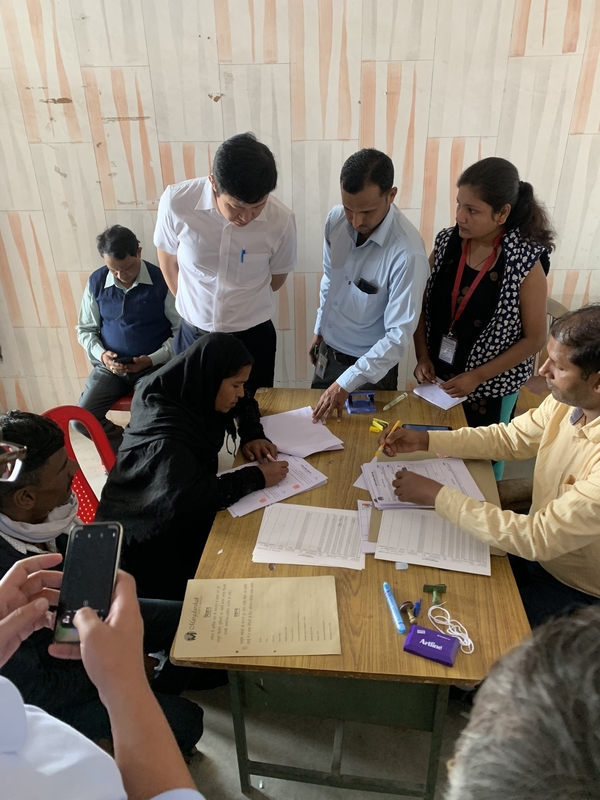

The field visit to understand customers’ experience with the use of digital solutions

With the support from MSC, the VBSP’s team visited and worked with these organizations including: Eko India Financial Services, Nucleus Software, Satin Creditcare Network Limited, Sonata Finance Private Limited, Margdarshak Financial Services Limited and Utkarsh Small Finance Bank.

The exposure visit helped VBSP’s team understand the microfinance model, Small Finance Bank (SFB) model and digital & physical distribution model of Payment Bank; the use of digital solutions in key processes such as customer acquisition, onboarding & training, loan disbursement & collection and portfolio monitoring. Besides, VBSP’s team also drew insights into MFI/SFB staff’s, agents and customer’s experience with the use of digital solutions.

The field visit to understand agents’ experience with the use of digital solutions

Eko is a banking agent serving the State Bank of India, ICICI Bank and Yes Bank. Agents will use Eko's application to transact with customers who are not familiar with the mobile banking. The customers will bring cash to the agents to make the transaction. The customers will receive SMS when the transaction is successful. Besides, the company also uses an outsourced call center to collect customer’s feedbacks. In particular, Eko manages customer information through ID cards, household registration and fingerprints, the customers can use fingerprints to confirm their transactions. In addition to transactions such as money transfers, withdrawals, the agents can also pay bills and loans for their customers.

The field visit to understand staff’s experience with the use of digital solutions

Nucleus Software is a leading provider of banking products and transactions for the financial services. In 2017, Nucleus Software launched the world's first offline and online digital loan management solution - PaySe for banks and customers. This system will help banks connect branches in rural areas to develop electronic payment and small credit development. PaySe mobile application helps banks and customers manage loans, make quick & simple payments without cash. This solution has a record keeping feature that allows banks and customers to track debt without maintaining a manual record. In addition, customers can use PaySe as an electronic wallet.

Satin Creditcare Network Limited is a microfinance institution, providing microcredit without collateral through responsible community groups including rural, semi-urban and urban women, who have difficulty in accessing official financial service providers in India. The company mainly disburses through customers' bank accounts and limits cash disbursement. In addition, the company can locate its customers on the map, locate the working position of their staff, locate and confirm the activities of the groups and customers such as team meetings, debt collection, and interest collection. Satin’s staff mostly use the mobile application to work with customers.

The field visit to understand customers’ experience with the use of digital solutions

Sonata Finance Private Limited operates as a microfinance institution, providing individual and group loans for income generation in various areas in India. Currently, the company completely digitizes its management and operations in its branches. The managers and officers only use mobile phone to make transactions. Only the head office has the computer system so the disbursement will take place at the head office, reducing the operation cost.

Utkarsh Small Finance Bank was established in 2009 with the mission of empowering the low-income groups financially. It was developed from a small microfinance institution to a digital bank. The process of automation is very high, even the bank's equipment can scan the financial statements of customers and then draft the appraisal report. The bank also focuses on encouraging customers to make cashless payments by providing digital banking training courses for their customers.

The visit of VBSP’s team to Utkarsh Small Finance Bank

Margdarshak Financial Services Limited is a comprehensive financial services provider, providing small loans to disadvantaged households using advanced technologies. All customer information is stored on cloud technology. The company can check customers through the fingerprint connected to the bar code on their ID when connecting to the national data source. In addition, the company uses a multi-function tablet to scan fingerprints, iris scan to verify transactions and has a printer attached to print receipts. The company disburses 100% via bank transfer to reduce the risk of cash transportation. This is also the first organization that customers can pay for multimedia such as cash, cards, transfers via e-wallets of different units.

VBSP’s team at Nucleus Software’s office

VBSP has successfully completed the exposure visit of digital banking services in India. The visit showed that the application of digital banking technology in the financial sector in general and the banking system in particular become more popular in the future. The visit also helped the VBSP’s team expand the relationship between VBSP and the financial institutions and banks in India. Thereby, VBSP’s team could explore new technology applications in financial services for the poor in India to apply to the VBSP’s system.

Thuy Trinh

- Vietnam’s Experience in Agricultural Development

- The exposure visit of the Nepal delegation of ASDP in Vietnam

- Nayoby Attapeu branch (Policy bank of Laos PDR) visited and worked with VBSP branch in Kon Tum province

- VBSP worked with the delegation from the Agricultural and Rural Development Bank of Cambodia

- Agriculture models in Vietnam are good to replicate in Nepal

- A high-ranking delegation of Vietnam Bank for Social Policies visits and works with the Nayoby Bank - Policy Bank of the Lao People’s Democratic Republic

- VBSP met and worked with the BIRD Senior Officials Delegation

- Asia Foundation Board Members field visit to VBSP at grassroot level

- VBSP contributes positively to the implementation of National targeted programs for sustainable poverty reduction

- Case study: Experiences in managing microfinance from VBSP is extremely valuable

- Algeria National Agency for Management of Microcredit study visit in VBSP

- Thailand Bank for Agriculture and Agricultural Cooperatives dispatch 9 delegations to study visits in VBSP

- Bank for Agriculture and Agricultural Cooperatives conduct study visits to VBSP

- VBSP welcome study delegation from Palli Karma-Sahayak Fund - Bangladesh in June 2012

- PALLI KARMA-SAHAYAK FOUNDATION OF BANGLADESH PAYS 4TH STUDY VISIT TO VIETNAM BANK FOR SOICAL POLICES

- STEM Credit - Nurturing Dreams of Knowledge

- 2025 Implementation Project Report “Promoting Financial Inclusion in the Development of the Cooperative Economy in the Digital Economy in Vietnam”

- Vietnam Bank for Social Policies and the Journey of Building a Public Financial Institution for the People

- Regulations on the Organization and Operations of Vietnam Bank for Social Policies (VBSP)

- Annual Report 2024

- Synchronizing solutions to ensure safe and effective credit operations

- VBSP'S PROGRESS REPORT IN 2025

- VBSP: Breakthrough in a year full of challenges

- Policy credit - The “midwife” of poverty reduction

- Dak Lak promotes social policy credit to advance sustainable poverty reduction in rural areas

LENDING INTEREST RATE

|

||||||||||||||||||||

DEPOSIT INTEREST RATE

|

||||||||||