News & Events

Asia Foundation Board Members field visit to VBSP at grassroot level

(VBSP News) On January 30th 2018, Vietnam Bank for Social Policies (VBSP) has held a field visit for twenty Board members of The Asia Foundation to a fix-date transaction point at Kieu Ky commune, Gia lam district, Hanoi with a view to get more understanding on VBSP’s operation model and its digital banking strategy for the poor in future.

Asia Foundation delegates visited and observed at fix-date transaction point, Kieu Ky commune, Gia Lam district, Hanoi

The purpose of the filed visit is for the Board members to observe the model of commune transaction that is an innovation in VBSP’s operation and contribution to raise VBSP as the top microfinance bank in Vietnam. Also, they have an opportunity to interact with VBSP staff and clients in microfinance and technology modernization for financial inclusion development.

VBSP is the only bank in Vietnam to reach the poor at rural, remote and mountainous areas through the innovative model of fixed-date transaction at commune/ward/town nationwide. It is one of the most effective and efficient delivery channels that help the last mile population in Vietnam access inclusive finance served by VBSP, mitigate travelling time and costs for borrowers. At communal transaction points, all inclusive finance programs including lists of active borrowers, outstanding loans, delinquency etc. are publicized to ensure transparent, public and adequate information at all level. On a fixed day of the month, the field staff of VBSP come to the commune to initiate direct transaction with borrowers in terms savings deposit, loan application and loan payment under witness of representatives from local mass organizations, heads of savings and credit Groups and relevant commune authorities.

Mr. Phan Cu Nhan, Public Relation Director of VBSP, is presenting about the commune transaction process at fix-date transaction point, Kieu Ky commune, Gia Lam district, Hanoi

The Asia Foundation delegates take a photo with the local governments, mass organization and VBSP representatives

The delegation visited a household customer who borrowed loan from VBSP for production of thin gold-leaves

Kieu Ky - a suburb commune in Gia Lam district, has been well known for two traditional professions: production of thin gold-leaves and leather-made goods. As of 10th January 2018 Gia Lam district branch has extended lending to 561 customers with total outstanding loan of over VND 16 billion.

100% of customers participate in savings with an average deposit of VND 50,000 - VND 100,000/ household. To date, the savings balance from the poor reaches VND 517 million in Kieu ky commune.

Mr. Phan Cu Nhan, Public Relation Director of VBSP, is giving brief introduction about VBSP history and development

VBSP has been operating in Vietnam from March 11th, 2003. VBSP is now in the top microfinance bank in Vietnam, and also ranked in the list of top five microfinance institutions in the world in terms of total assets and customer base. To date, VBSP has 63 provincial branches, 631 district transaction offices, approximately 11,000 transaction outlets at commune/ward and around 190,000 savings and credit groups in village and hamlet. VBSP enables financial inclusion of the poor and other disadvantaged groups through grassroots networks, appropriate infrastructure, socialized procedures and skillful employees. VBSP’s vision is to become a leading retail and universal bank promote financial inclusion to the mass market, typically the last mile population.

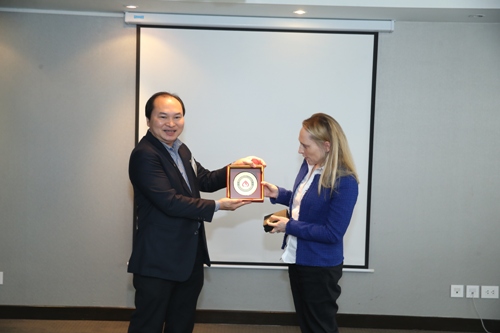

The Asia Foundation delegation received a souvenir from VBSP for closer cooperation and partnership between two sides in future

Since 2016, VBSP collaborated with The Asia Foundation and MasterCard to launch the project “Mobile banking – Financial inclusion and economic empowerment for the low-income population and women in Vietnam” supported by Australian Government’s Business Partnerships Platform (BPP).

Track 1: VBSP launches free SMS notification services for customersto receive updated information on accounts, VBSP’s financial products& services, Repayment schedules, Debt reminders, Monthly account balance,etc.

Track 2: VBSP develops a digital banking roadmap and launches 3 stages: Stage 1 - Pilot cash-in service via mobile banking for 850 group leaders and around 30,000 group members; Stage 2 &3 - VBSP rolls out mobile banking service nationwide and providesother mobile-based services such as: bill payment, P2P, QR pay, etc, and card issuance.

VBSP News

- Policy credit empowers women to rise and stabilize their livelihoods

- STEM Credit - Nurturing Dreams of Knowledge

- 2025 Implementation Project Report “Promoting Financial Inclusion in the Development of the Cooperative Economy in the Digital Economy in Vietnam”

- Vietnam Bank for Social Policies and the Journey of Building a Public Financial Institution for the People

- Regulations on the Organization and Operations of Vietnam Bank for Social Policies (VBSP)

- Synchronizing solutions to ensure safe and effective credit operations

- VBSP'S PROGRESS REPORT IN 2025

- VBSP: Breakthrough in a year full of challenges

- Policy credit - The “midwife” of poverty reduction

- Dak Lak promotes social policy credit to advance sustainable poverty reduction in rural areas

- Boosting green credit for sustainable development in Viet Nam

- Over 124,000 Soc Trang households escape poverty

- Binh Thuan province combats poverty with microfinance

- Nearly 1.5 million ethnic minority households access financial services and products

- Improve livelihoods for ethnic minority in remote, mountainous areas

- Efficiency of financial products and services for the poor in Da Nang

- Sustainable poverty reduction by microfinance

- Help the poor to access policy credit and financial services

- VBSP attended Financial Inclusion workshop on “Agricutural and rural finance in Vietnam”

- Inclusive finance help reduce poverty

- Policy credit empowers women to rise and stabilize their livelihoods

- VBSP promotes green inclusive finance towards sustainable development

- STEM Credit - Nurturing Dreams of Knowledge

- 2025 Implementation Project Report “Promoting Financial Inclusion in the Development of the Cooperative Economy in the Digital Economy in Vietnam”

- Vietnam Bank for Social Policies and the Journey of Building a Public Financial Institution for the People

- Regulations on the Organization and Operations of Vietnam Bank for Social Policies (VBSP)

- Annual Report 2024

- Synchronizing solutions to ensure safe and effective credit operations

- VBSP'S PROGRESS REPORT IN 2025

- VBSP: Breakthrough in a year full of challenges

LENDING INTEREST RATE

|

||||||||||||||||||||

DEPOSIT INTEREST RATE

|

||||||||||