Press Release

Policy credit helps people surmount pandemic challenges

(VBSP News) Like other business entities and organizations, the Bac Giang branch of Vietnam Bank for Social Policies has been operating at full throttle after the social distancing, bringing policy credit to each commune and hamlet, helping local residents resume production and stabilize life.

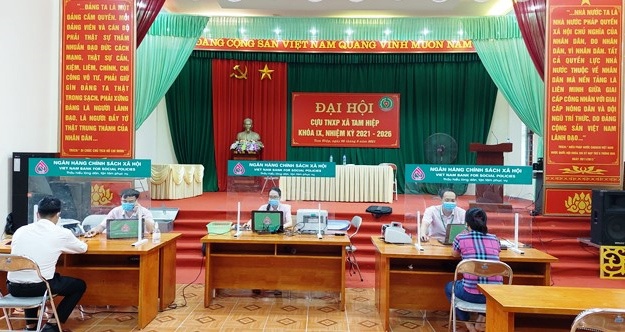

Ensuring safe transactions at VBSP Bac Giang’s service units at grassroots level

Bac Giang is the first locality in Vietnam eyeing strong resurgence from the fourth wave of the COVID-19 pandemic. The pandemic has taken place across local industrial zones (IZs) with a high concentration of workers, causing severe losses.

However, within just two months, with the determination of the local government and people hailing from ethnic groups, Bac Giang has successfully pushed back the pandemic and returned to a new normal since mid-June.

Accordingly, right after social distancing measures were relaxed, the Bac Giang branch of Vietnam Bank for Social Policies (VBSP Bac Giang) has reopened its doors for customers including needy households and other policy beneficiaries from across the province.

The branch consists of 10 district-level transaction offices and 209 commune-level transaction points employing nearly 150 employees, along with more than 1,000 staff from four local socio-political organisations receiving authorised capital sources from the branch to lend to people in need.

The bank’s policy credit has found its way into the villages and hamlets in the province, helping people to reboot production and business, gradually stabilising their life.

Fruit orchards bring high yields to the family of Giap Van Tien in Luc Ngan district, who took up a VND50 million ($2,170) loan from VBSP Bac Giang

One eminent example of the efforts to eradicate difficulties is the family of Ban Thi Hue in Dong Dinh hamlet, Binh Son commune, Luc Nam district who belongs to the Dao ethnic minority.

In 2016, Hue was lent VND40 million($1,740) by VBSP Bac Giang to raise buffalos and grow specialty fruit trees like Bo Ha orange and Phuc Trach grapefruit. Through diligent labour, her family has reported constantly improving living standards.

Right after Bac Giang contained the fourth wave of the pandemic, Hue was lent another VND100 million ($4,350) of concessionary credit to expand the VACR (garden-pond-cage-forest) model to cultivate her dream of making a fortune right at her home town.

In Yen Dung district near the city of Bac Giang, policy credit has helped needy local households contain nature and opt for a suitable and efficient production model to lead their life. For instance, the family of Nong Van Hung from Nung ethnic minority group in Dong Tien commune, Yen The district has used the loan to raise specialty chicken and plant 3 hectares of Acacia hybrids.

More than 25,000 needy households and people from ethnic minority groups based in Bac Giang have become the beneficiaries of a VND5.139 trillion ($223.43 million) policy credit package from Bac Giang VBSP to grow specialty fruit orchards, raise cattle, increase forest coverage, and embrace diverse occupations for stable incomes.

“Over the long journey of 19-year development, despite facing multiple hardships and challenges, particularly those associated with the on-going fourth wave of COVID-19 the bank has strictly followed guidance from the parent bank and local leadership, taking diverse measures to enrich capital sources to effectively implement the state’s policy credit programs,” said Ha Quoc Quan, director of VBSP Bac Giang. “Therefore, our bank has now accommodated ample capital sources to feed operation approximating $226 million, up $17.7 million compared to 2020.”

Policy credit always a central task

Credit signing ceremony to lend employers affected by COVID-19 at VBSP Bac Giang

The ample capital sources have come from concerted efforts by local management authorities at all levels who have always taken policy credit activities as their central task, from there giving favorable conditions helping VBSP Bac Giang to build up strong capital sources serving people’s needs.

After seven years of implementing Directive No.40/CT-TW of the Secretariat on strengthening the Party’s leadership towards policy credit, the bank has received VND168.5 billion ($7.33 million) worth of authorized capital from the People’s Committees at diverse levels to lend to needy people and other policy beneficiaries in the province.

Through the system of 3,116 saving and lending groups at grassroots level and a network of 209 transaction points the bank’s staff have effectively tackled the capital demands of local people and businesses.

As of now, 64 businesses were given more than VND200 billion ($8.7 million) preferential credit at zero per cent interest to pay wages for nearly 59,000 laborers.

VBSP Bac Giang also takes the lead in the VBSP system with the largest outstanding loan balance volume earmarked to support firms in payment for workers with work suspension and rebounding production.

A highlight in the operation of VBSP Bac Giang is that the bank staff are well-trained with high dedication and sound experience in their field who could quickly embrace new procedures and policy credit provision methods to better serve the people.

Through VBSP Bac Giang’s operation, policy credit has become an effective tool helping Bac Giang to successfully implement the national target program on poverty reduction, ensuring social well-being in a sustainable manner, surmounting the difficulties caused by nature and effectively containing the pandemic.

During the period 2016-2020, Bac Giang reported a stable drop in the number of poor households averaging 2.23 per cent annually. The rate even reached 4-5 per cent in several communes with particularly difficult conditions for development.

Vir.com.vn

- VBSP promotes green inclusive finance towards sustainable development

- VBSP offers preferential loans to students, master’s students, and doctoral candidates in science, technology, engineering, and mathematics (STEM) fields

- Annual Report 2023

- The VBSP’s Board of Directors (BOD) held its regular meeting for the fourth quarter of 2024

- Annual Report 2022

- VBSP implements tasks for the year 2025

- Credit policies under Decision 22 for ex-prisoners to rebuild lives in Ha Nam

- Households in disadvantaged areas can borrow up to VND 100 million for business and production.

- VBSP's Trade Union worked with the Korean Finance Union delegation

- Promotion of digital financial services to enable financial inclusion for the disadvantaged population in Vietnam

- Training course “Green finance for renewable energy development in Viet Nam”

- Prime Minister appoints VBSP staff

- Newsletter Vol 10.2021

- Solutions on VBSP’s social and environmental risk management

- The effectiveness of credit loans to pay wages for work stoppage and production recovery

- Digital technology application and resource mobilization towards the implementation of green banking project

- VBSP' Hung Yen branch: A helping hand to needy people

- VBSP's implementation results on green credit programs

- Specific risk management system at VBSP

- Internal policies and regulations on environmental, social and climate risk in VBSP

- Policy credit empowers women to rise and stabilize their livelihoods

- VBSP promotes green inclusive finance towards sustainable development

- STEM Credit - Nurturing Dreams of Knowledge

- 2025 Implementation Project Report “Promoting Financial Inclusion in the Development of the Cooperative Economy in the Digital Economy in Vietnam”

- Vietnam Bank for Social Policies and the Journey of Building a Public Financial Institution for the People

- Regulations on the Organization and Operations of Vietnam Bank for Social Policies (VBSP)

- Annual Report 2024

- Synchronizing solutions to ensure safe and effective credit operations

- VBSP'S PROGRESS REPORT IN 2025

- VBSP: Breakthrough in a year full of challenges

LENDING INTEREST RATE

|

||||||||||||||||||||

DEPOSIT INTEREST RATE

|

||||||||||