News & Events

Digital technology application and resource mobilization towards the implementation of green banking project

(VBSP News) In fact, the bank operations have a direct impact on the environment. Aware of that, through the technology application, VBSP gradually implements digital transformation, automate some professional activities and internal systems to improve operational efficiency towards VBSP’s goal of green banking operations.

VBSP is implementing human resource management, operation management, administrative management, online document approval, trade union accounting, Intellect system operation administration support, emulation and commendation management, Policy Credit Management Software, online data provision software for directing and administration, iTrans software (increasing data processing to ensure timely data synchronization from the central to branches), automation to de-documentation of payment means.

On the technology platform, VBSP is continuing to build and transform the technology system to develop Mobile Banking electronic transaction channels, non-cash payment methods and services. From that, VBSP gradually modernizes banking operations, improves operational efficiency and service quality for borrowers, contributing to the effective implementation of green banking and green credit projects.

Financial literacy for customers via mobile application

In order to propagate, train and improve understanding of social policy credit, green economic development and VBSP’s services for customers, since 2017, VBSP has officially implemented financial literacy program through the free periodic SMS service for customers.

In addition, in 2019, VBSP collaborated with Oxfam to build a mobile (smartphone) application for comprehensive financial education for customers, especially the poor and other disadvantaged groups in rural, remote, border areas and islands with the name of NHCSXH-GDTC. This is a new initiative in the field of financial inclusion and is the only non-financial application serving the poor in the banking system. The application has been officially deployed since 2020 with over 15 thousand registered users. The goal of the application is to inform customers, especially customers in rural and remote areas, about VBSP’s credit programs, policies, loan procedures, savings and payment services; some typical loan models and financial education for them such as personal and household financial management, production and business support, etc.; helping them improve their financial understanding, promote the efficiency of capital use, and gradually familiarize with digital technology.

This application not only contributes to helping the poor and other policy beneficiaries gradually access digital technology, VBSP's diversified financial products and services, but it also contributes to the development of the National Strategy on financial inclusion, typical effective business models.

Technology application requirement to develop green credit and manage environmental, social and climate risks

VBSP needs to build an information technology system to manage customer data; classify detailed credit; classify risky debt according to the causes such as natural disaster, climate; credit scoring system (if applicable) and more detailed and accurate reporting information system.

Capital mobilization forms

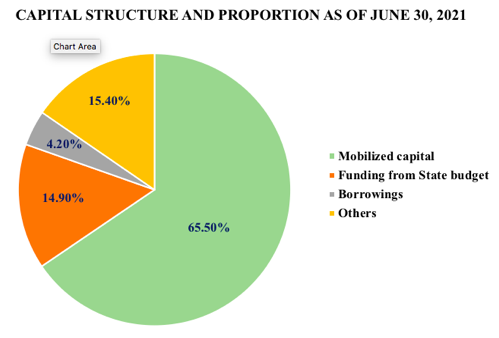

VBSP’s operating capital resources are complied with the provisions of Chapter II of Decree No. 78/2002/ND-CP dated October 4, 2002 of the Government on credit for the poor and other policy beneficiaries, including: funding from the State Budget; borrowings and mobilized funds; voluntary non-refundable funds from domestic and international individuals, economic organizations, financial institutions, credit institutions, socio-political organizations, associations and non-governmental organizations; entrusted capital from local state budget and other investors; other funds and capital. It can be said that capital mobilization is one of the important activities of VBSP and is regulated in Decree No. 78/2002/ND-CP as following “Receiving deposits with interest from domestic and international organizations and individuals within the scope of the approved annual plan; receiving deposits from credit institutions; interest-free voluntary deposits from domestic and international organizations and individuals; issuing Government-guaranteed bonds, certificates of deposit and other valuable papers; mobilizing the savings of the poor”.

VBSP’s capital mobilization products

- Group of receiving deposits: (1) Receiving 2% deposits from state-owned credit institutions; (2) Demand deposits; (3) Term deposits of organizations and individuals paying interest at the beginning of the period; (4) Term deposits of organizations and individuals paying periodic interest; (5) Term deposits of organizations and individuals paying interest at the end of the period; (6) Demand savings deposits; (7) Term savings deposits paying interest at the beginning of the period; (8) Time savings deposits paying periodic interest; (9) Term savings deposits paying interest at the end of the period; (10) Demand savings deposits at Commune Transaction Points; (11) Term savings deposit with early interest payment at Commune Transaction Points; (12) Term savings deposits with periodic interest payments at Commune Transaction Points; (13) Term savings deposits paying interest at the end of the period at Commune Transaction Points; (14) Receive savings deposits of SCG members; (15) Labor deposit in Korea.

- Group of loan products: (1) Borrowings from credit institutions on the interbank market; (2) Borrowings from the State Bank; (3) Re-borrowings foreign concessional loans of the Government.

- Valuable papers issuance: Issuing VBSP bonds guaranteed by the Government.

- Entrusted capital: (1) Entrusted capital from the local budget; (2) Entrusted capital from domestic and international organizations and individuals.

- Other products and services of VBSP

In order to support the poor, near-poor households and other policy beneficiaries to have more choices to access savings products in the fast, convenient, safe, and cost-effective manner; VBSP has deployed deposit products of SCG members and deposit mobilization products at Commune Transaction Points. VBSP has also implemented a SMS service for customers. Its service fees are paid by VBSP to help customers promptly know their information about loan and deposit balance; due debt; overdue debt; account balance. Moreover, VBSP cooperates with BIDV in providing WU remittance payment service at transaction points; deploys money transfer service through inter-bank electronic payment system; pilots the transfer of cash supply for VBSP's operations and service provision.

VBSP receives entrusted preferential loans from local governments, economic organizations, socio-political organizations, associations, NGOs, domestic and international individuals.

Achievements

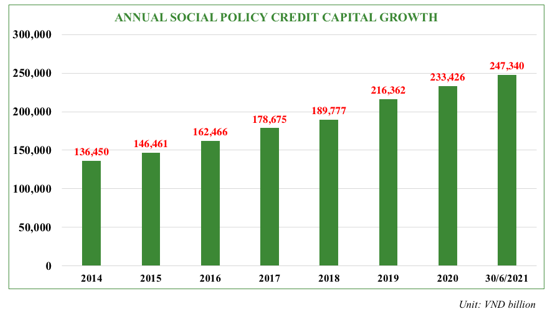

In the period 2011-2020, the growth rate of total policy credit capital reached an average of 10% per year. The size of the total policy credit capital increased by 2.6 times, from VND 90,400 billion in 2010 to VND 233,426 billion as of December 31, 2020.

Receiving entrusted capital from the local budget is a prominent feature in concentrating resources for implementing social policy credit during the implementation of the Strategy. Entrusted local budget capital reached VND 20,315 billion, an increase of VND 18,029 billion (8.9 times) compared to 2010.

Resource requirements for green credit development

- Most of VBSP's capital is mobilized according to the annual growth target, guaranteed by the Government.

- Beside the current portfolio, in order to develop new green credit products such as green and renewable energy products, VBSP needs to be supported in capital mobilization channels such as issuing government-guaranteed bonds receiving entrusted and mobilized capital in the market according to regulations.

Vbsp.org.vn

- Policy credit empowers women to rise and stabilize their livelihoods

- STEM Credit - Nurturing Dreams of Knowledge

- 2025 Implementation Project Report “Promoting Financial Inclusion in the Development of the Cooperative Economy in the Digital Economy in Vietnam”

- Vietnam Bank for Social Policies and the Journey of Building a Public Financial Institution for the People

- Regulations on the Organization and Operations of Vietnam Bank for Social Policies (VBSP)

- Synchronizing solutions to ensure safe and effective credit operations

- VBSP'S PROGRESS REPORT IN 2025

- VBSP: Breakthrough in a year full of challenges

- Policy credit - The “midwife” of poverty reduction

- Dak Lak promotes social policy credit to advance sustainable poverty reduction in rural areas

- VBSP' Hung Yen branch: A helping hand to needy people

- VBSP's implementation results on green credit programs

- Specific risk management system at VBSP

- Internal policies and regulations on environmental, social and climate risk in VBSP

- Methods of social policy credit lending and management

- Poverty mitigation efforts prove highly effective

- Social policy credit for each different objective and beneficiary, serving the national target programs

- VBSP’s operational strategy and sustainable development goals

- Newsletter Vol 09.2021

- Evaluates the implementation of Covid-19 support loan to pay salaries for employees ceasing working and salaries during business recovery

- Policy credit empowers women to rise and stabilize their livelihoods

- VBSP promotes green inclusive finance towards sustainable development

- STEM Credit - Nurturing Dreams of Knowledge

- 2025 Implementation Project Report “Promoting Financial Inclusion in the Development of the Cooperative Economy in the Digital Economy in Vietnam”

- Vietnam Bank for Social Policies and the Journey of Building a Public Financial Institution for the People

- Regulations on the Organization and Operations of Vietnam Bank for Social Policies (VBSP)

- Annual Report 2024

- Synchronizing solutions to ensure safe and effective credit operations

- VBSP'S PROGRESS REPORT IN 2025

- VBSP: Breakthrough in a year full of challenges

LENDING INTEREST RATE

|

||||||||||||||||||||

DEPOSIT INTEREST RATE

|

||||||||||