News & Events

VBSP provides various credit schemes for the poor and other last mile population

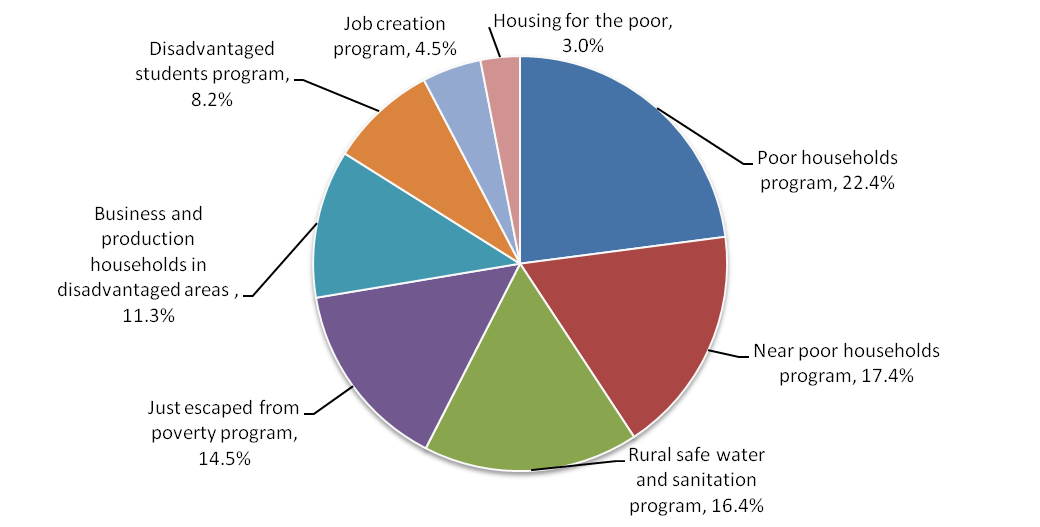

Since VBSP’s inception, the credit programs have changed over the time to adapt the market need. With the primary target of providing loans to the poor households, after 17 years of operation, VBSP has developed various programs to cover the demand of poor and last mile segment as much as possible. As the decline of the number of the poor households, VBSP launched a number of new programs to support the poor and other beneficiaries demand in many aspects. The below figure show the major products running in VBSP with the large client bases.

Besides developing the additional programs, VBSP considers to increase the loan size for available programs. Particularly, in 2019, the poor program and job creation program has been raised in its loan size up to VND 100 million. The addition of capital and the increase of the limit and the loan term have raised access opportunities and promoted the efficiency of loans for the local people. The maximum loan size for disadvantaged students will increase from VND 1.5 million/month/student to VND 2.5 million/month/student. This is a credit program with meaningful purposes in terms of economics, politics and society, contributing to creating human resources for the country.

- STEM Credit - Nurturing Dreams of Knowledge

- 2025 Implementation Project Report “Promoting Financial Inclusion in the Development of the Cooperative Economy in the Digital Economy in Vietnam”

- Vietnam Bank for Social Policies and the Journey of Building a Public Financial Institution for the People

- Regulations on the Organization and Operations of Vietnam Bank for Social Policies (VBSP)

- Synchronizing solutions to ensure safe and effective credit operations

- VBSP'S PROGRESS REPORT IN 2025

- VBSP: Breakthrough in a year full of challenges

- Policy credit - The “midwife” of poverty reduction

- Dak Lak promotes social policy credit to advance sustainable poverty reduction in rural areas

- Supporting reintegration and stable livelihoods for rehabilitated individuals

- VBSP broadens banking service network and channels

- Newsletter Vol 16

- Financial inclusion: Empower Vietnamese women

- Poor households are supported to access VBSP's inclusive finance

- Effective credit policy for ethnic minority

- VBSP conducted the exposure visit to India on learning digital finance transformation

- Resources mobilized to improve livelihoods of the poor

- Disadvantaged laborers given help to work abroad

- VBSP’s inclusive finance helps farmers get rich

- Drug-detoxified people are supported to borrow loans from VBSP

- STEM Credit - Nurturing Dreams of Knowledge

- 2025 Implementation Project Report “Promoting Financial Inclusion in the Development of the Cooperative Economy in the Digital Economy in Vietnam”

- Vietnam Bank for Social Policies and the Journey of Building a Public Financial Institution for the People

- Regulations on the Organization and Operations of Vietnam Bank for Social Policies (VBSP)

- Annual Report 2024

- Synchronizing solutions to ensure safe and effective credit operations

- VBSP'S PROGRESS REPORT IN 2025

- VBSP: Breakthrough in a year full of challenges

- Policy credit - The “midwife” of poverty reduction

- Dak Lak promotes social policy credit to advance sustainable poverty reduction in rural areas

LENDING INTEREST RATE

|

||||||||||||||||||||

DEPOSIT INTEREST RATE

|

||||||||||